Merely saying that things are difficult right now feels like a massive understatement. Having been in financial services for over 15 years, I’ve seen downturns that have impacted parts of every industry. But it almost goes without saying that, along with hospitality (which has lost 7.7 million jobs), it’s likely that no single sector has been impacted as severely as the airline industry.

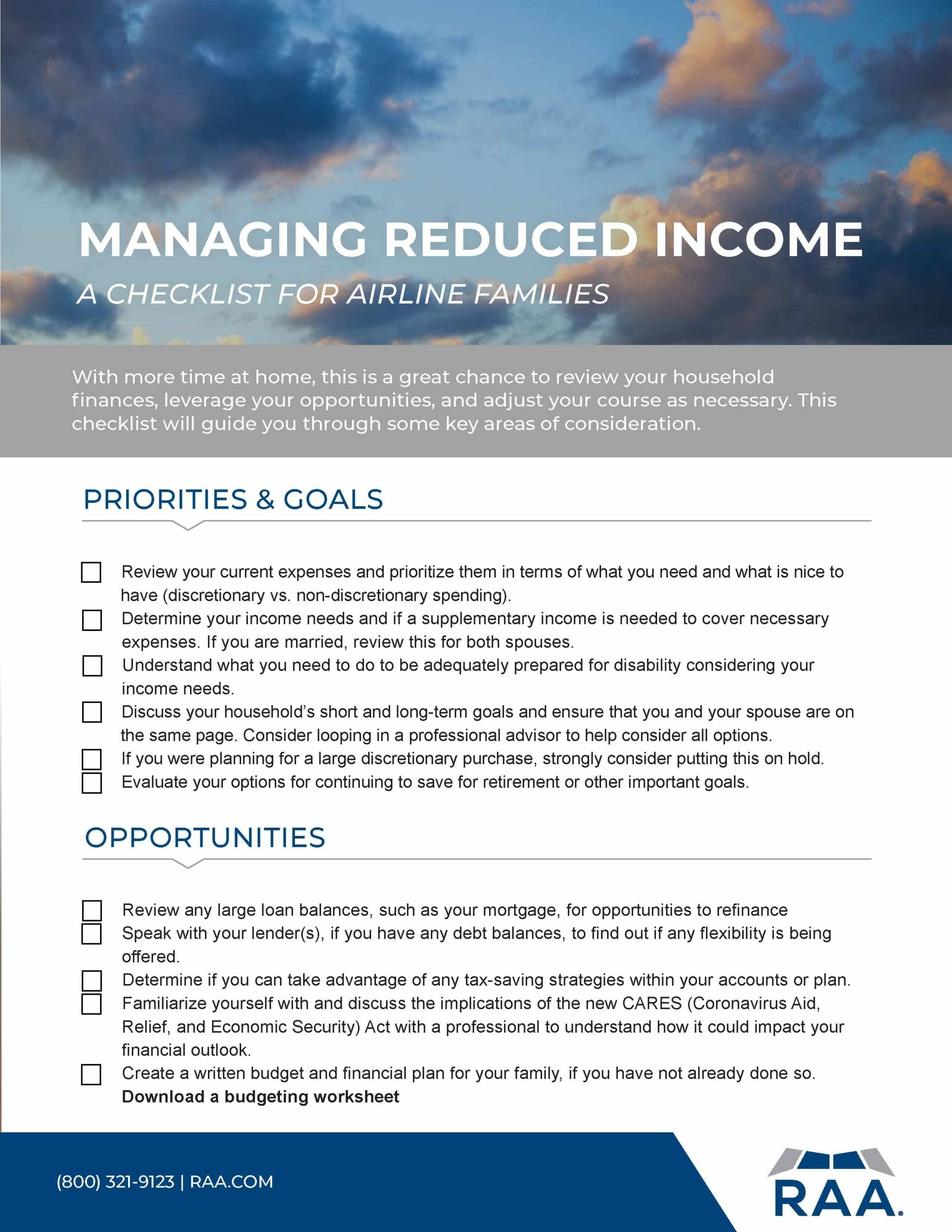

While there is no silver bullet, when your livelihood is affected and your income is reduced, there are some hard-but-necessary things you need to do right now to get by until you’re again flying with a regular schedule.

The first thing I recommend you do is to get a tight grip on your spending and create a realistic budget. You’re going to be determining your monthly income needs.

Start by writing down all your monthly expenses, including your mortgage or rent, property taxes, utilities, vehicle payments, timeshares, cable and internet, club memberships, phones, yard and pool maintenance, housekeeping – any and all recurring fees. Everything. Don’t forget to include your visits to Starbucks! You’ve got to know precisely where your money is going, and then decide what cuts you can and cannot make.

Next, review a couple of months of purchases, then calculate an average of your expenditures for groceries, gas, and things you regularly purchase or order online.

Next, list all your unsecured debt, including credit cards, lines of credit and any student loans, and the monthly payment amounts for each. I’ve found that when those I advise really start paying attention to exactly how much they owe and spend, and where precisely that money is going, it becomes much easier to slash expenses and save.

Next comes prioritization. You’re going to want to revisit your short- and long-term financial goals. How much out-of-pocket (after tax) money have you been saving? What have you been saving for? What can wait, what can’t, and what can be adjusted or repurposed to best accommodate the changes to your income? Call any creditors and explain your situation. Right now, many creditors are offering to suspend interest and even payments, so if you call and don’t get the answer you need, call again and speak with someone else.

Whenever a client’s income takes a hit, the next thing I recommend is that they evaluate their immediate, short-term opportunities. For instance, the 883-page CARES Act (the Coronavirus Aid, Relief, and Economic Security Act) has several provisions, including mortgage forbearance for up to 360 days and as a last resort, penalty-free withdrawals from your tax-deferred retirement accounts (such as a 401(k) or IRA) of up to $100,000. (You have until the end of 2020 to do this.)

As an important aside, while these are obviously extreme circumstances, I strongly encourage you to think very carefully before tapping into your retirement savings. While thankfully, you won’t get hit with the usual 10% penalty (for taking a withdrawal before age 59½), you will still be required to pay taxes on any withdrawals. The upside is that you’ll have three years to do it.

Next, depending on your situation, there are also some potentially great tax-saving strategies such as tax-loss harvesting and Roth conversions. Briefly, tax-loss harvesting is when you intentionally sell a “losing” stock (a stock that has lost value) to offset realized gains on other investments. (Couples could save up to $3,000.)

A Roth conversion could also make sense, because you might be able to take advantage of your temporarily lower tax burden (or bracket) to rollover your tax-deferred retirement account(s) (into a Roth). You’ll have to pay taxes on the withdrawal, but once inside a Roth, not only does the money grow (and be withdrawn) tax free, there are no required minimum distributions when you reach age 72.

Next, for homeowners, because money not going out equates to money coming in, now might be the ideal time to refinance your mortgage to a lower interest rate. The key is to reduce monthly outflow and conserve cash, even if it means refinancing to a 20 or 30-year loan.

While you have a lot of decisions to make, it’s likely that you have options, so it’s imperative that you make the absolute best choices for your unique situation. (Because some of these approaches are complex, you should consider, if you haven’t already, procuring the help of a fiduciary advisor.)

The last thing I’m going to recommend is that you do everything you can to keep yourself protected for the future. For instance, it may seem logical to charge everything on a credit card, paying it back later when things return to normal and some may have to do this. But as a reminder, if there are any other ways, you owe it to yourself and your future to assess those options first.

While you need to cut expenses, you also need to make certain they are the right expenses. I’m referring to things like insurance coverage. Try not to let any key coverages lapse or, I’m sorry to say, you run the risk of making a bad situation even worse.

Unfortunately, this is high-stakes financial chess, and the decisions you make right now will have long-lasting implications. For 30-years, our firm has specialized in working with and guiding airline families, and because many of our team members and representatives are former, or even active, pilots, my connection to the airline industry runs deep.

My thoughts are with you during this difficult time. Please know your options and continue to do your best to stay on course. We will get through this.